Sales Tax On Gifted Car In Massachusetts . — without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. — you may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. to save on sales tax, gift or sell your car to a family member or spouse. There is no sales tax for a vehicle that is transferred to another person as a gift. — the following are the most current versions of massachusetts department of revenue motor vehicle. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. do i have to pay sales tax on a gifted car in massachusetts? In massachusetts, vehicle transactions between family members are exempt.

from www.formsbank.com

— without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. do i have to pay sales tax on a gifted car in massachusetts? — the following are the most current versions of massachusetts department of revenue motor vehicle. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. — you may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. In massachusetts, vehicle transactions between family members are exempt. There is no sales tax for a vehicle that is transferred to another person as a gift. to save on sales tax, gift or sell your car to a family member or spouse.

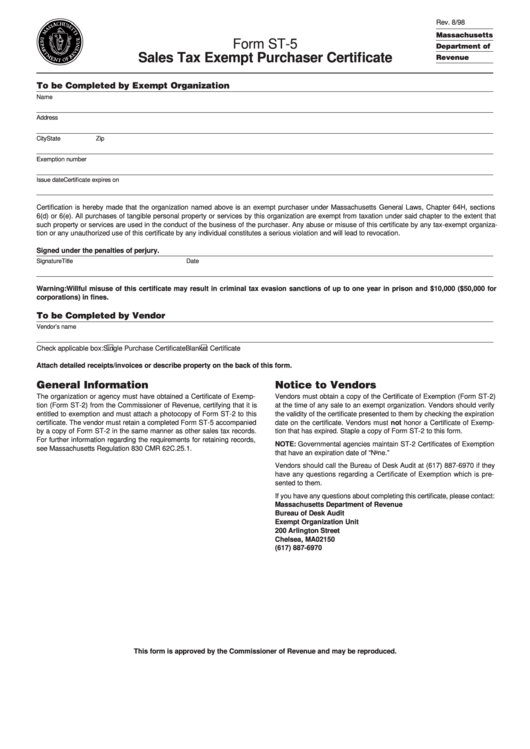

Form St5 Sales Tax Exempt Purchaser Certificate Massachusetts

Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. do i have to pay sales tax on a gifted car in massachusetts? to save on sales tax, gift or sell your car to a family member or spouse. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. In massachusetts, vehicle transactions between family members are exempt. — you may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. There is no sales tax for a vehicle that is transferred to another person as a gift. — the following are the most current versions of massachusetts department of revenue motor vehicle.

From exosylqer.blob.core.windows.net

Gifting Land Uk at Herbert Leite blog Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. There is no sales tax for a vehicle that is transferred to another person as a gift. In massachusetts, vehicle transactions. Sales Tax On Gifted Car In Massachusetts.

From dxovrpdvm.blob.core.windows.net

Selling A Vehicle In Oklahoma at Calvin Urena blog Sales Tax On Gifted Car In Massachusetts In massachusetts, vehicle transactions between family members are exempt. — you may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. to save on. Sales Tax On Gifted Car In Massachusetts.

From hxevigpge.blob.core.windows.net

Car Sales Tax In Stockton Ca at Magdalena Rucker blog Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. — you may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. In massachusetts, vehicle transactions. Sales Tax On Gifted Car In Massachusetts.

From www.hotzxgirl.com

Free Template Car Bill Of Sale Ri Tokyojes Hot Sex Picture Sales Tax On Gifted Car In Massachusetts There is no sales tax for a vehicle that is transferred to another person as a gift. — the following are the most current versions of massachusetts department of revenue motor vehicle. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. — you may be exempt from. Sales Tax On Gifted Car In Massachusetts.

From templatelab.com

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab Sales Tax On Gifted Car In Massachusetts In massachusetts, vehicle transactions between family members are exempt. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. There is no sales tax for a vehicle that is transferred to another person as a gift. do i have to pay sales tax on. Sales Tax On Gifted Car In Massachusetts.

From hxeyijtis.blob.core.windows.net

Sales Tax Washington State Car Rental at Kevin Petersen blog Sales Tax On Gifted Car In Massachusetts — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. — the following are the most current versions of massachusetts department of revenue motor. Sales Tax On Gifted Car In Massachusetts.

From hxetjbisw.blob.core.windows.net

Property Tax Gifted Car at Jacques Kline blog Sales Tax On Gifted Car In Massachusetts — the following are the most current versions of massachusetts department of revenue motor vehicle. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. There is no sales tax for a vehicle that is transferred to another person as a gift. — without paying taxes on it,. Sales Tax On Gifted Car In Massachusetts.

From autosdonation.com

Do You Pay Taxes On A Gifted Car In Missouri? Sales Tax On Gifted Car In Massachusetts — the following are the most current versions of massachusetts department of revenue motor vehicle. do i have to pay sales tax on a gifted car in massachusetts? to save on sales tax, gift or sell your car to a family member or spouse. — you may be exempt from paying sales tax on a vehicle. Sales Tax On Gifted Car In Massachusetts.

From www.vrogue.co

Massachusetts Bill Of Sale Form Templates 3 Free Temp vrogue.co Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. There is no sales tax for a vehicle that is transferred to another person as a gift. — you may be exempt from paying sales. Sales Tax On Gifted Car In Massachusetts.

From www.vrogue.co

Sample Letter Of Explanation For Mortgage Download Pr vrogue.co Sales Tax On Gifted Car In Massachusetts — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. to save on sales tax, gift or sell your car to a family member or spouse. In massachusetts, vehicle transactions between family members are exempt. There is no sales tax for a vehicle that. Sales Tax On Gifted Car In Massachusetts.

From legaltemplates.net

Free Gifted Car Bill of Sale Template PDF & Word Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. In massachusetts, vehicle transactions between family members are exempt. — the following are the most current versions of massachusetts department of. Sales Tax On Gifted Car In Massachusetts.

From autosdonation.com

Do You Pay Taxes On A Gifted Car In New York? Sales Tax On Gifted Car In Massachusetts to save on sales tax, gift or sell your car to a family member or spouse. do i have to pay sales tax on a gifted car in massachusetts? — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. In massachusetts, vehicle transactions between family members are exempt.. Sales Tax On Gifted Car In Massachusetts.

From mungfali.com

Affidavit Of Sale Of Motor Vehicle Sales Tax On Gifted Car In Massachusetts — the following are the most current versions of massachusetts department of revenue motor vehicle. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the. Sales Tax On Gifted Car In Massachusetts.

From giodgorin.blob.core.windows.net

Sales Tax In Massachusetts On Cars at Richard Rohrbaugh blog Sales Tax On Gifted Car In Massachusetts — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. There is no sales tax for a vehicle that is transferred to another person as a gift. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving. Sales Tax On Gifted Car In Massachusetts.

From howtostartanllc.com

Massachusetts Sales Tax Small Business Guide TRUiC Sales Tax On Gifted Car In Massachusetts In massachusetts, vehicle transactions between family members are exempt. — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. — the following are the most current versions of massachusetts department of revenue motor vehicle. — if the sale is made by a motor vehicle or trailer dealer or. Sales Tax On Gifted Car In Massachusetts.

From www.formsbank.com

Form St5 Sales Tax Exempt Purchaser Certificate Massachusetts Sales Tax On Gifted Car In Massachusetts do i have to pay sales tax on a gifted car in massachusetts? — without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax. Sales Tax On Gifted Car In Massachusetts.

From mavink.com

Affidavit Sale Of Motor Vehicle Sales Tax On Gifted Car In Massachusetts — you must pay the tax on a gifted car in massachusetts within 10 days of receiving the vehicle. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. do i have to pay sales tax on a gifted car in massachusetts? . Sales Tax On Gifted Car In Massachusetts.

From cashier.mijndomein.nl

Gift Letter Template Sales Tax On Gifted Car In Massachusetts — the following are the most current versions of massachusetts department of revenue motor vehicle. — without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift. — if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the. Sales Tax On Gifted Car In Massachusetts.